SpreadEdge Capital specializes in seasonal spread trading across a wide variety of commodity markets. A spread trade is the simultaneous purchase and sale of the same commodity with different delivery dates. SpreadEdge publishes a weekly Newsletter that provides several seasonal spread trade opportunities every week.

% Carry Yield

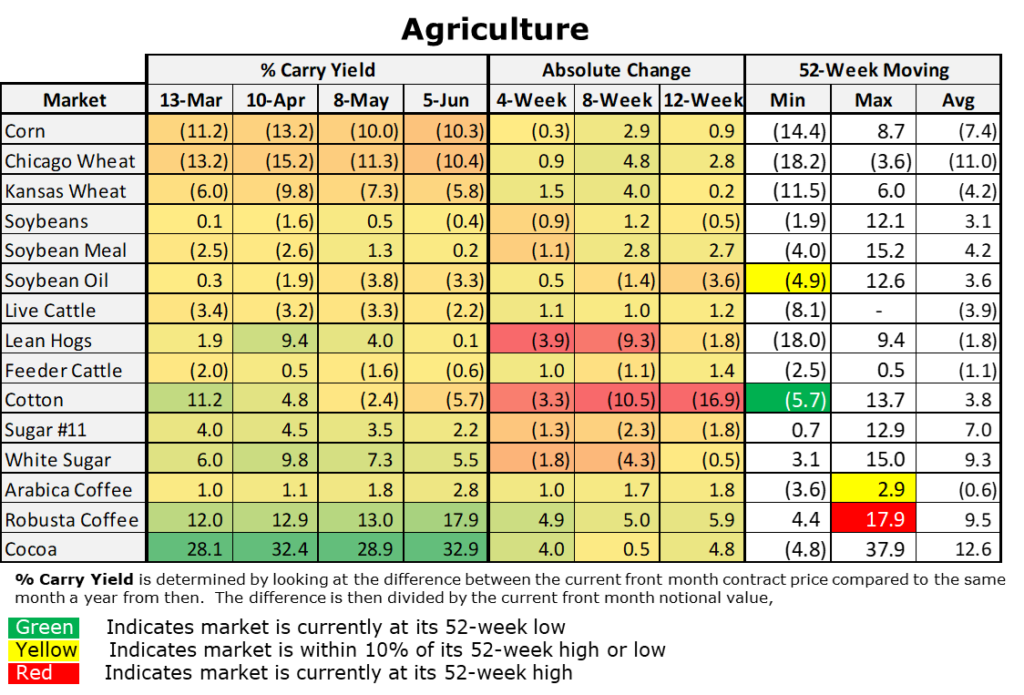

Futures calendar curves vary in shape over time. Some often invert, with front-month contract prices exceeding those of later contracts, resulting in positive carry. Conversely, some curves exhibit contango, leading to a negative carry. Below are the % carry yields for most of the Ag markets. Note that all data is based on the end of day close from Tuesday of each week.

Agriculture % Carry Yield

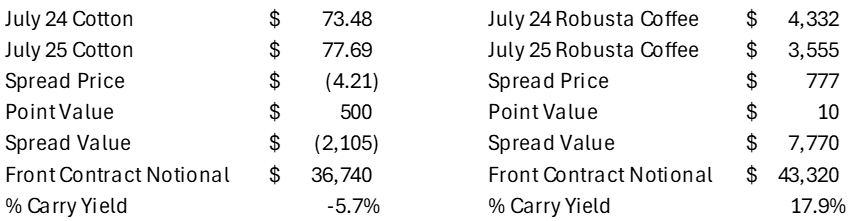

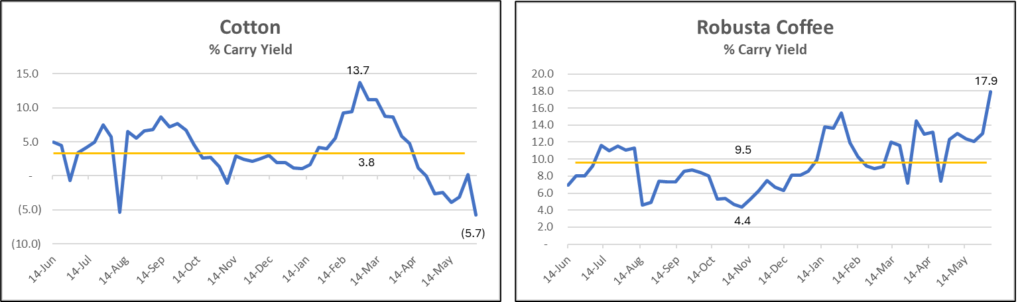

- Cotton reached its 52-week low for the week with a % carry yield of (5.7%). Note that Cotton bounced hard back in August from (5.1%) to just under 10% in just 5 weeks.

- Robusta Coffee is on an opposite path and reached its 52-week high with a % carry yield of 17.9%. RC has peaked above 14% twice in 2024 and has fallen to below 8% quickly each time.

- Soybean Oil is within 10% of its 52-week low and Arabica Coffee is within 10% of its 52-week high.

52-Week Graphs

How to Trade These Markets

Seasonality is turning positive for Cotton and I considering a long Cotton butterfly spread for early next week. Robusta Coffee is in a seasonally positive phase through most of June and doesn’t turn negative until July. I am hoping that RC remains at these elevated levels until seasonality turns negative.

More Information

Use coupon code “SpreadEdge” and get the Weekly Newsletter and Daily Alerts for $1 for the first month.

For a limited time, you can receive my Futures Training Videos for free with a 3-month, 6-month, or 12-month subscription.

For a FREE eBook about the SpreadEdge seasonal spread strategy.

The SpreadEdge Weekly Newsletter is published every weekend and provides a broad overview of the important seasonal, technical, and fundamental indicators within the Energy, Grains, Meats, Softs, Metals and Currency markets. In addition, spread trade recommendations and follow-up on open trades is also provided. For a free copy of the Weekly Newsletter, please send an email to info@SpreadEdgeCapital.com

Darren Carlat

SpreadEdge Capital, LLC

(214) 636-3133

Darren@SpreadEdgeCapital.com

Disclaimer

SpreadEdge Capital, LLC is registered as a Commodity Trading Advisor with the Commodity Futures Trading Commission and is an NFA member. Past performance is not indicative of future results. Futures trading is not suitable for all investors, The risk associated with futures trading is substantial. Only risk capital should be used for these investments because you can lose more than your original investment. This is not a solicitation.

On the date of publication, Darren Carlat did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.