Overview

August Soybeans traded down to the 1131.25 major Gann square and closed back above the 1157.00 swing point for the week, this can cause a sharp rally. November had a few closes below the long term 61.8% level at 1110.00, but had no follow through and now back above it bringing back the 61.8% target above.

The break from the 421.75 swing point in the September Corn hit the 400.75 major Gann square, it needs to get back above the long term 78.6% level at 410.00 to say a rally is coming. The break in December from the 441.00 swing point for the week hit the long term 78.6% level at 410.00 target, we will now watch the retracements above to see if this market can get a big rally going.

September Wheat is still holding the 557.50 major Gann square and a good rally is possible from here. December is still holding the long term 8.6% level at 557.50 and the long term target is 78.6% the other way based on the ONE44 78.6% rule.

August Live Cattle is trading up at a long term 78.6% level and we still believe that a good setback can happen from here.

August Lean Hogs are holding above a long term 61.8% retracement and a rally to 61.8% the way is possible as long as they hold 87.00, this is based on the ONE44 61.8% rule.

.

We have a new Video on how to use the 78.6% Fibonacci retracement.

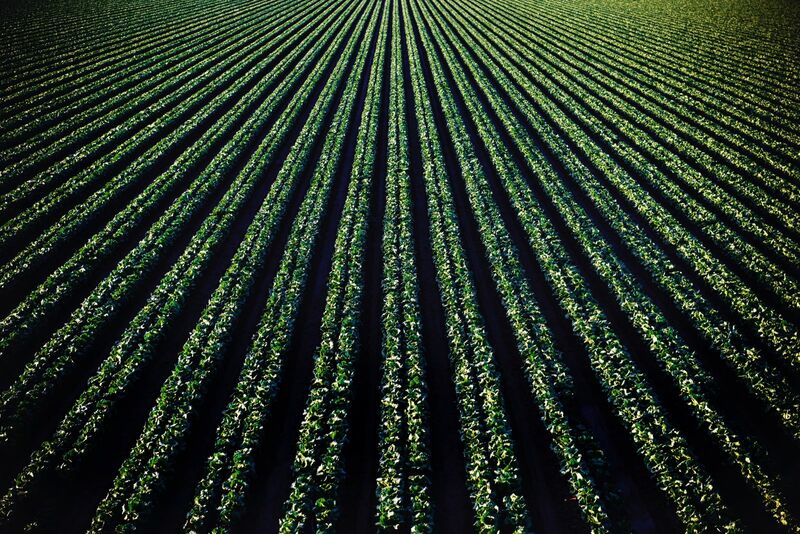

Soybeans

August

From last week,

Use 1157.00 as the swing point for the week.

Below it, you still have to watch how it trades at the 1131.25 major Gann square, holding this level after taking out the 2/29/24 low and closing back above 1157.00 can cause a sharp rally. The long term target is ……

The break from 1157.00 hit the 1131.25 major Gann square and is now back above the 1157.00 swing point for the week, this is a 61.8% level on the continuation chart, staying above this can be the start of a good rally.

Use 1157.00 as the swing point for the week again.

Above it, The long term target is 61.8% back to the 11/15/23 high at 1293.00 based on the ONE44 61.8% rule. The short term target is 38.2% of the same move at 1231.00. Any rally that can’t get back above the 1184.50 major Gann square is a negative sign and new lows can quickly follow.

Below it, failure to turn higher from 1157.00 will give us a long term target of 78.6% on the continuation chart at 999.00. The short term target is the 1077.75 major Gann square.

ONE44 Analytics where the analysis is concise and to the point

Our goal is to not only give you actionable information, but to help you understand why we think this is happening based on pure price analysis with Fibonacci retracements, that we believe are the underlying structure of all markets and Gann squares.

If you like this type of analysis and trade the Grain/Livestock futures you can become a Premium Member.

You can also follow us on YouTube for more examples of how to use the Fibonacci retracements with the ONE44 rules and guidelines.

Sign up for our Free newsletter here.

FULL RISK DISCLOSURE: Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Commission Rule 4.41(b)(1)(I) hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Past performance is not necessarily indicative of future results.

On the date of publication, Nick Ehrenberg did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.